TotalEnergies has reached an agreement to sell its 12.5% non-operated interest in Nigeria’s OML 118 oil block to Shell Nigeria Exploration and Production Company (SNEPCo), in a $510 million deal that reinforces Shell’s commitment to offshore oil production in Nigeria.

The French energy major disclosed on May 29, 2025, that the transaction, conducted through its local subsidiary TotalEnergies EP Nigeria, is subject to customary conditions, including regulatory approvals. The OML 118 Production Sharing Contract (PSC) includes the Bonga and Bonga North deepwater oilfields, located approximately 120km offshore the Niger Delta.

Once completed, Shell’s equity in OML 118 will rise to 67.5% from the current 55%. The move marks Shell’s growing emphasis on offshore investments in Nigeria following its divestment of onshore assets to Renaissance, a consortium of four domestic companies and one international energy group.

According to TotalEnergies, OML 118 is operated by SNEPCo (55%) in partnership with Esso Exploration and Production Nigeria (20%), Nigerian Agip Exploration (12.5%), and formerly, TotalEnergies (12.5%). The Bonga field began production in 2005, while the Bonga North development—approved in December 2024—is expected to begin producing by the end of the decade. In 2024, TotalEnergies’ share of production from OML 118 amounted to approximately 11,000 barrels of oil equivalent per day.

Nicolas Terraz, President of Exploration and Production at TotalEnergies, said the divestment aligns with the company’s global strategy to focus on low-emission, low-cost assets. “TotalEnergies continues to actively high-grade its upstream portfolio, focusing on assets with low technical costs and emissions. In Nigeria, our priority is on operated gas and offshore oil assets, including the development of the Ubeta gas project, which will support supply to Nigeria LNG,” Terraz said.

The decision underscores TotalEnergies’ broader repositioning in Nigeria’s oil and gas sector, where it has operated for over 60 years. The company employs more than 1,800 people across upstream, downstream, and marketing operations, and maintains a nationwide fuel distribution network that includes approximately 540 service stations.

Shell’s acquisition of the OML 118 stake comes as it accelerates development of the Bonga North deepwater project, which will be tied back to the existing Bonga Floating Production Storage and Offloading (FPSO) facility. The project holds an estimated 300 million barrels of recoverable oil equivalent and is expected to reach peak output of 110,000 barrels per day.

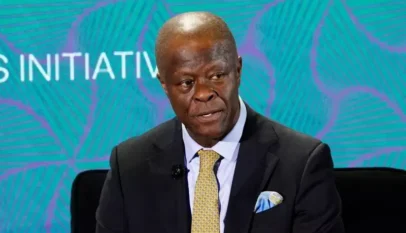

Peter Costello, Shell’s President of Upstream, said the deal reflects the company’s long-term confidence in Nigeria’s offshore oil and gas sector. “Following our final investment decision on Bonga North, this acquisition is another step in reinforcing Shell’s upstream presence in Nigeria through focused investment in deepwater assets,” he stated.

The Shell-TotalEnergies deal is the latest in a series of portfolio adjustments by international oil companies operating in Nigeria, balancing geopolitical risks, regulatory challenges, and decarbonisation targets with the region’s vast energy potential.