By Douglas Maha and Deborah Nnamdi

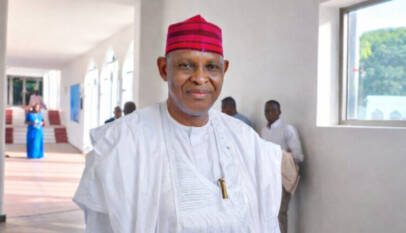

Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service (FIRS)—soon to be renamed the National Revenue Service (NRS)—has announced that the recently signed four tax reform bills will come into effect on January 1, 2026.

Adedeji explained that the start date allows for a six-month window to facilitate planning, public awareness, and alignment with the fiscal calendar.

He made this known while speaking to State House Correspondents on Thursday, June 26, 2025, following the signing of the bills by President Bola Tinubu at the Presidential Villa.

He added that sufficient time is needed for stakeholders, operators, and regulators to adapt to the new system.

Adedeji, in his address, explained, “Based on best practices globally, because when you have this kind of change, it takes time for all the stakeholders, participant operators, and even the regulator to change the system.

“So with the magnanimity of the National Assembly, Mr. President, the effective date will be January 1, 2026, by the special grace of Almighty God. We have six full months for both sensitisation and planning. This is also considering the fiscal year of the government because when you have this kind of change, it’s not what you do in the media.’’

Adedeji stressed the importance of launching the reforms at the start of a new calendar year, saying, “When you have this kind of change, it’s not what you do mid-year. Because if the application of the law is better, you start from the beginning of the year.

“So effective dates, by God’s grace, will be the first of January 2026,” he added.

Confirming the date, the Special Assistant to the FIRS Chairman, Dare Adekanmbi, said the January 1, 2026, effective date will give all stakeholders enough time to digest the contents of the new tax laws and adjust accordingly as the new laws cannot be imposed on taxpayers in the middle of the fiscal year.

He said, ‘’This will give all stakeholders enough time to digest the contents of the new tax laws and adjust accordingly. More so, new laws cannot be imposed on taxpayers in the middle of the financial/fiscal year.’’

Here’s a comprehensive overview of Nigeria’s new tax reform laws that have recently been signed and will come into effect on 1 January 2026

Overview: Four Key Bills Signed into Law

- Nigeria Tax Act

- Nigeria Tax Administration Act

- Nigeria Revenue Service (Establishment) Act

- Joint Revenue Board (Establishment) Act

Implementation Timeline

- Signed by President Tinubu in June 2025.

- Effective date: 1 January 2026

- Approved a 6-month transition period for public sensitisation, system upgrades, and training.

Major Changes & Provisions

1. Value-Added Tax (VAT)

- Retained temporarily at 7.5% (House) but Senate proposes increase to 12.5% in 2026, then gradually to 15% by 2030 (vanguardngr.com)

- Zero-rated VAT on essentials like food, healthcare, education, public transport, and rent

- Revised VAT revenue-sharing:

- 70% to local governments, 30% to states (House)

- Senate shift: increased proportion to revenue-generating states; cap proposed to ease regional tensions

2. Personal Income Tax (PIT)

- Tax-free threshold raised to ₦800,000–₦1,000,000 per annum

- Graduated tax bands apply beyond this, topping out at 25% for >₦50 million income

3. Company Income Tax (CIT) & Development Levy

- Lowered CIT:

- 27.5% in 2025

- 25% from 2026 onward

- Exemption for SMEs (turnover < ₦50 million) from CIT, VAT, WHT, PAYE

- Introduced the Development Levy on the profits of larger companies:

- 4% in 2025–2026,

- 3% in 2027–2029,

- 2% from 2030

4. Tax Administration & Governance

- FIRS was restructured and renamed as Nigeria Revenue Service (NRS), with clearer mandates, autonomy, and a funding model

- Strengthened Joint Revenue Board, Tax Appeal Tribunal, and Office of Tax Ombud—all with independent funding and stricter evidence rules

- Updated administrative procedures:

- TIN issuance extended to 5 days

- Accelerated filing deadlines (e.g., 3 months for ceased operations)

- Electronic invoicing, fiscalisation, and access rights formalised

5. Petroleum & Digital Economy

- Oil-sector gains tax reduced from 85% to 30%

- Tax incentives for oil sector cost-efficiency—up to 20% credit for operators reducing costs (reuters.com)

- Formal taxation of digital assets & crypto gains:

- Gains from digital assets are treated like capital gains; ~10% CGT applies

Benefits of the New Tax Law

Main Issues

| Issue | Concern |

|---|---|

| VAT distribution | May favour wealthier southern states; northern governors resisted (ft.com) |

| Inflation & cost impact | Potential VAT hike to 12.5% or above could drag consumption; offset by zero-rates |

Experts tout the law as a landmark overhaul aimed at creating a fairer, more efficient, and modern tax system, especially favourable to low-income earners, SMEs, and essential sectors. With a structured rollout beginning in 2026, it paves the way for stronger revenue collection, economic equity, and digital compliance.