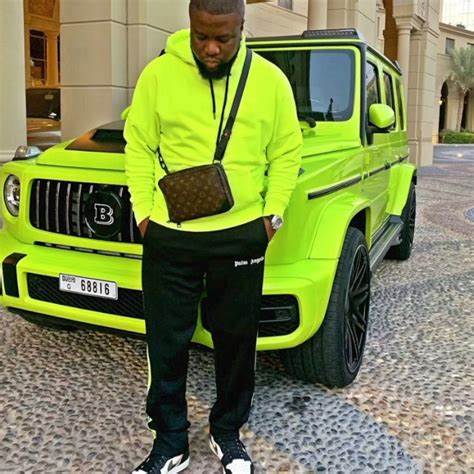

The case of Ramon “Hush Puppi” Abbas and his fellow fraudster, Obi Okeke (known as Invictus Obi), captured global headlines when the two Nigerian men were arrested and charged with multi-million-dollar fraud schemes targeting high-profile individuals, businesses, and governments.

Hushpuppy, an Instagram influencer whose larger-than-life lavish lifestyle, held his audience spellbound, was sentenced to 11 years in the U.S. for his role in a series of cyber-enabled crimes, including business email compromises and wire fraud.

Hush Puppi flaunted a luxurious lifestyle funded by proceeds of fraud

Invictus Obi, a self-acclaimed entrepreneur, who was listed in Forbes Africa’s 30 Under-30 Honour was sentenced to an 11-year jail term for his involvement in a similar scheme that defrauded various companies and individuals across the globe.

The Hushpuppy and Invictus Obi cases were not isolated incidents; they represent a worrying trend of Nigerian nationals involved in global fraud syndicates and operations, many of which target victims in the United States. While Hushpuppy and Invictus Obi remain two of the most notorious figures, the list of Nigerians ensnared in similar schemes continues to grow, with many individuals recently caught and convicted for large-scale financial crimes.

In recent years, the U.S. Department of Justice (DOJ) has uncovered a series of fraudulent activities orchestrated by Nigerian nationals, ranging from business email compromise (BEC) schemes to romance fraud, money laundering, and even pandemic relief fraud. These schemes have defrauded Americans and international victims of millions of dollars, with many perpetrators sentenced to long prison terms.

Some Shareholders in Scam PLC (L-R) Nwadialu, Ezemma, Invictus Obi, Oludayo Adeagbo, Kolade Ojelade, and Hush Puppi

Amos Prince Okey Ezemma

Amos Prince Okey Ezemma, a 50-year-old Nigerian, was recently convicted and sentenced to 85 months imprisonment in the United States for his involvement in a large-scale inheritance fraud scheme. This scheme targeted elderly Americans, deceiving over 400 victims into sending funds under the pretence of securing a multi-million-dollar inheritance from a deceased family member.

Ezemma and his co-conspirators orchestrated the scam by sending personalized letters that claimed to represent a Spanish bank handling the inheritance. Victims were instructed to pay various fees, including taxes and delivery charges, but ultimately received nothing in return.

Ezemma’s case is part of a broader investigation involving six individuals, all of whom have now faced legal action in the U.S. His conviction, along with those of his co-defendants, resulted in sentences ranging from 82 to 128 months in prison. Authorities, including the U.S. Postal Inspection Service and Homeland Security Investigations, worked with international agencies to dismantle this operation. The group was ordered to pay over $6 million in restitution to their victims, demonstrating significant international collaboration in combating transnational fraud targeting vulnerable populations.

OLUDAYO KOLAWOLE JOHN ADEAGBO

Oludayo Kolawole John Adeagbo, a dual Nigerian-UK citizen, was involved in complex business email compromise (BEC) fraud schemes that targeted educational institutions, government entities, and businesses in the U.S., aiming to steal millions of dollars. In these schemes, Adeagbo and his associates used fraudulent emails that closely resembled those of legitimate companies to deceive their targets into transferring large sums of money into accounts they controlled.

Notably, he and co-conspirators orchestrated scams involving a North Carolina university and various Texas entities, including construction companies and local governments, with total attempted thefts exceeding $5 million.

Extradited from the UK in 2022, Adeagbo was charged and later sentenced to seven years in prison for his role in these schemes. His sophisticated methods involved registering domain names similar to actual companies, crafting deceptive emails, and quickly transferring the stolen funds to obscure their origin. He has been ordered to pay restitution to victims and will be under supervised release following his prison term. This case underscores the serious financial and security impacts of BEC scams on institutions and highlights international collaboration in prosecuting cybercrime.

YOMI JONES OLAYEYE

Yomi Jones Olayeye, also known as “Sabbie,” is a Nigerian who was recently arrested in the U.S. on charges linked to a $10 million COVID-19 unemployment fraud scheme. According to U.S. authorities, Olayeye, along with other accomplices, allegedly used stolen personal data to file for unemployment benefits through various U.S. state assistance programs like traditional unemployment insurance (UI), Pandemic Unemployment Assistance (PUA), and Federal Pandemic Unemployment Compensation (FPUC). These claims spanned multiple states, including Massachusetts, Hawaii, Indiana, and Michigan, yielding over $1.5 million in illegally acquired funds. The fraudulent gains were reportedly funnelled into purchases of Bitcoin to help disguise the origins of the money, while IP addresses in the U.S. were leased to mask connections to Nigeria.

The U.S. Department of Justice notes that if convicted, Olayeye faces up to 20 years in prison, along with additional penalties for wire fraud and identity theft. His case highlights the ongoing efforts by U.S. authorities to combat pandemic-related fraud and misuse of government assistance programs.

SAKIRU OLANREWAJU AMBALI AND FATIU ISMAILA LAWAL

Sakiru Olanrewaju Ambali and Fatiu Ismaila Lawal were involved in a substantial fraud scheme targeting U.S. COVID-19 relief programs. The two Nigerian nationals, residing in Canada, allegedly used stolen identities to file fraudulent unemployment benefit claims across more than 25 U.S. states, submitting around 1,700 claims valued at approximately $25 million. They successfully received around $2.4 million, primarily from pandemic unemployment benefits. The fraudulent activities included creating multiple accounts and email addresses to facilitate claims and employing money mules to handle funds.

Ambali, arrested in Germany and later extradited to the U.S., recently pled guilty and awaits sentencing. Lawal remains in Canada awaiting extradition to face similar charges. Their case highlights the complex international collaboration between U.S. agencies, including the FBI and Department of Labor, to combat pandemic-related fraud and bring perpetrators to justice.

BABATUNDE FRANCIS AYENI

Babatunde Francis Ayeni, a 33-year-old Nigerian national living in the United Kingdom at the time of his arrest, was sentenced to 10 years in federal prison by a U.S. federal court for his role in a large-scale cyber fraud scheme that targeted real estate transactions across the United States. Ayeni was involved in a sophisticated business email compromise (BEC) scheme, through which he and his co-conspirators illegally accessed email accounts of real estate professionals, such as attorneys and agents, to intercept and redirect funds. By posing as legitimate transaction participants, they instructed victims to wire funds to accounts under their control, causing significant financial losses.

This scheme impacted over 400 individuals and led to a collective financial loss of nearly $20 million, with more than half of the victims unable to recover their funds. Ayeni’s case is part of a broader U.S. Department of Justice crackdown on Nigerian nationals engaged in cyber fraud schemes, as other individuals involved in similar BEC frauds have faced extradition and sentencing in recent months.

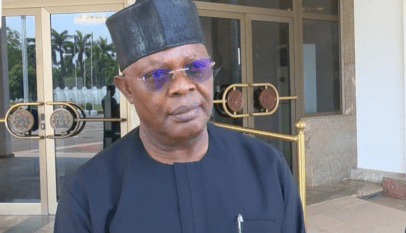

FRANKLIN IKECHUKWU NWADIALO, Current Chairman, Ogbaru LGA, Anambra

The case of Franklin Ikechukwu Nwadialo, who is the current chairman of Ogbaru Local Government Council of Anambra State, is one of the most disturbing and disgraceful to the image of Nigeria. The 40-year-old suspected fraudster turned politician was indicted and later arrested in Texas on charges of romance fraud involving approximately $3.3 million last week.

U.S. authorities allege that Nwadialo used fake profiles and aliases such as “Giovanni” to connect with victims on dating platforms, including Match, Zoosk, and Christian Café, posing as a deployed U.S. military member. Over several years, he fabricated various urgent financial needs tales, asking victims for funds to pay military fines, cover family funeral expenses, or support investments, and subsequently funnelled these amounts into his controlled accounts. One victim alone reportedly lost over $2.4 million in this scheme.

Nwadialo’s arrest underscores U.S. law enforcement’s commitment to prosecuting international fraud cases. He faces serious penalties for each count of wire fraud, with potential prison sentences extending up to 20 years. The FBI continues to investigate these cases to support the prosecution efforts.

AMOWIE KELVIN IMATITIKUA

Amowie Kelvin Imatitikua, a 37-year-old Nigerian national, was involved in a sophisticated fraud scheme spanning 2019 to 2021. He pled guilty in July 2024 to multiple charges including bank fraud, conspiracy to commit bank fraud, and money laundering. Imatitikua’s role in the operation involved using fraudulent identities and foreign passports to open bank accounts. These accounts were used to launder the proceeds of various scams, including pandemic relief fraud and romance scams, with over $400,000 in illicit funds funnelled through them.

Imatitikua’s guilty plea now faces severe penalties, including up to 30 years in prison for bank fraud and up to 20 years for money laundering. A sentencing hearing is scheduled for this November.

KOLADE AKINWALE OJELADE

Kolade Akinwale Ojelade, a 34-year-old Nigerian national, was sentenced to 26 years in federal prison for his involvement in a large-scale cyber fraud scheme. This scheme targeted real estate transactions in the United States, utilizing phishing and email spoofing tactics to intercept and alter wire transfer instructions. Ojelade gained unauthorized access to real estate business email accounts, monitored communications about large financial transactions, and modified wiring details to divert funds to accounts controlled by him and his accomplices.

The intended loss from this scheme was over $100 million, and the actual loss amounted to around $12 million. Ojelade was sentenced to 292 months for wire fraud and an additional 24 months for aggravated identity theft, to run consecutively. He was also ordered to pay over $3.3 million in restitution. After serving his sentence, he will be deported to Nigeria.

EBUKA RAPHAEL UMETI AND FRANKLIN IFEANYICHUKWU OKWONNA

Ebuka Raphael Umeti and Franklin Ifeanyichukwu Okwonna, two Nigerian nationals, were sentenced in the U.S. for their involvement in a business email compromise (BEC) scheme that caused over $5 million in losses to several victims. Umeti, 35, was sentenced to 10 years in prison, while Okwonna, 34, received five years and three months. Both were also ordered to pay nearly $5 million in restitution.

From 2016 to 2021, they, along with co-conspirators, orchestrated a sophisticated fraud operation by sending phishing emails disguised as communications from trusted sources like banks or vendors.

These emails contained malware, which, when opened by the victim, gave the fraudsters unauthorized access to the victims’ computer systems. Using this access, they deceived businesses into transferring large sums to accounts controlled by the perpetrators.

HENRY ONYEDIKACHI ECHEFU

Henry Onyedikachi Echefu, a Nigerian national, was recently implicated in a large-scale Business Email Compromise (BEC) scheme alongside co-conspirators Kosi Goodness Simon-Ebo and James Junior Aliyu. The group was involved in a sophisticated operation from 2016 to 2017, using spoofed emails to deceive U.S. companies and individuals into wiring funds into “drop accounts” controlled by the perpetrators. This operation reportedly led to a total loss of over $6 million. Echefu managed around $22,000 of these stolen funds, which were subsequently moved through various accounts and withdrawals to obfuscate the money trail.

After being extradited from Canada, Echefu faced charges of conspiracy to commit wire fraud and conspiracy to commit money laundering in the United States. In March 2024, he pleaded guilty to these charges and now faces a potential sentence of up to 20 years in federal prison. His plea also requires him to pay restitution, covering the amount he handled as part of the fraud.

CHRISTOPHER AGBAJE

Christopher Agbaje, a Nigerian citizen, was sentenced to 11 years and 10 months in U.S. federal prison for his involvement in a fraud and money laundering scheme targeting a law firm in North Dakota. Agbaje and his associates posed as a client involved in a legal dispute and convinced the law firm to deposit a fraudulent check for nearly $200,000. The firm, believing the check to be legitimate, transferred the funds to Agbaje’s business partner, who then attempted to wire part of the money internationally. Agbaje was ultimately extradited from the UK to the U.S., where a federal jury found him guilty of money laundering and aiding and abetting wire and mail fraud.

UCHE VICTOR DIUNO

Uche Victor Diuno, a Nigerian national, was sentenced to 60 months in federal prison in May 2024 for his involvement in a multimillion-dollar fraud scheme. Diuno participated in an international investment fraud that defrauded victims across over 20 countries. Working with a network of accomplices, he used fake identities and misleading emails to solicit payments for non-existent investment opportunities. Diuno’s role included managing and distributing fraudulent funds through U.S. bank accounts, often funnelling the money back to associates in Nigeria and using some of it for personal luxuries like cars.

The U.S. Department of Justice, along with the FBI and the Department of State’s Office of Inspector General, conducted an extensive investigation into this case. The fraudulent operation relied on convincing victims of the legitimacy of fake financial opportunities, preying on their hopes of securing profitable investments. After completing his prison term, Diuno is likely to face deportation proceedings back to Nigeria.

AKINOLA TAYLOR, OLAYEMI ADAFIN, OLAKUNLE OYEBANJO, AND KAZEEM OLANREWAJU RUNSEWE

This quartet of Nigerian fraudsters (Akinola Taylor, Olayemi Adafin, Olakunle Oyebanjo, and Kazeem Olanrewaju Runsewe) were extradited to the United States to face charges in a significant transnational fraud case. The indictment alleges that these individuals were involved in a conspiracy to commit wire fraud and identity theft, specifically targeting U.S. residents. Their activities reportedly included unauthorized access to American business servers to steal personal identifying information (PII), which they then used to file fraudulent tax returns with the IRS, aiming to collect refunds.

The scheme also involved collecting proceeds through prepaid debit cards, controlled addresses, and bank accounts, with proceeds then distributed among co-conspirators. The case was tied to the xDedic Marketplace, a now-defunct platform that sold access to compromised servers and PII, facilitating cybercrime on an international scale. Taylor and Runsewe allegedly used this platform to execute the fraud, which led to global enforcement efforts coordinated by U.S. and international law enforcement agencies, including the FBI and IRS.

If convicted, the defendants face up to 20 years in prison on charges of wire fraud, with additional penalties for identity theft and related offences. The U.S. also plans to seize any assets traceable to the frauds proceed.