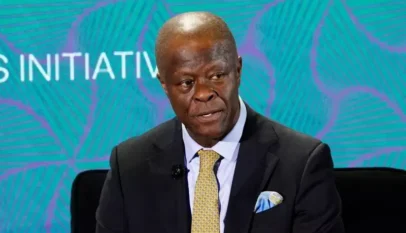

Photo: Mr Olawale Edun, Nigeria’s Finance Minister

Douglas Maha, Abuja

In a move that has garnered international attention and sparked praise among economists, global rating agency Fitch has elevated Nigeria’s long-term foreign-currency issuer default rating from “B–” to a stable “B’”.

This upgrade, contained in the international agency’s latest release on Friday, reflects a dramatic transformation in the nation’s economic management and signals growing confidence among investors.

Since June 2023, Nigeria has set off on an ambitious reform program aimed at restoring fiscal discipline and economic transparency. The government has implemented a host of measures—from liberalizing the exchange rate and tightening monetary policy to ending deficit monetization and eliminating long-standing fuel subsidies.

“These reforms are not just cosmetic,” noted Professor Emeka Igbinedion, a respected economist at the University of Lagos. “They are a sincere effort to re-engineer Nigeria’s economic framework, which is long overdue.”

The impact of these bold measures is becoming increasingly evident in Nigeria’s financial sector. The Central Bank of Nigeria has introduced an electronic foreign exchange matching platform and revamped the FX code, steps that have significantly boosted market transparency and liquidity.

“What we are seeing is a clear sign that Nigeria is laying the foundation for a more predictable and robust FX market,” said Dr. Adisa Ogunbiyi, a senior analyst at the Centre for Economic Recovery. He added, “An almost 90% increase in net official FX inflows in the fourth quarter of 2024, after a sharp depreciation earlier in the year, highlights both the market’s resilience and the impact of these reforms.”

Inflation, which has been a chronic challenge, is projected to decline gradually—with forecasts suggesting an average of about 22% in 2025 and a further dip to approximately 20% in 2026—provided that monetary authorities maintain their current tightening stance.

“Any premature easing in monetary policy could reverse the hard-fought gains we have achieved so far,” cautioned Ngozi Nwankwo, an independent financial consultant based in Abuja.

Nigeria’s external reserves have also shown encouraging signs of recovery. Following a mid-2024 low of $32 billion, reserves climbed to a peak of $41 billion by year-end before moderating slightly to about $38 billion amid increased debt service demands.

In parallel, the country’s energy sector is gearing up for improvements as the Dangote refinery is set to expand its capacity from 0.55 million barrels per day to 0.65 mbpd by mid-2025. Crude oil production is expected to edge higher over the coming years, although structural challenges such as underinvestment remain.

Despite these promising developments, risks persist, notably in the volatile global oil market. “Lower oil prices remain the most significant external risk to Nigeria’s fiscal health,” explained John Mensah, Chief Economist at Global Finance Insights. “They could erode the improved external buffers and fiscal metrics, testing the robustness of the current policy framework.”

Fitch’s upgrade is much more than a routine rating change—it represents an endorsement of Nigeria’s sweeping reforms and its renewed commitment to economic stabilization. As these policies take hold, experts believe Nigeria is poised to redefine its economic narrative from one of chronic instability to one marked by resilience and growth, with improved investor sentiment paving the way for a more prosperous future.