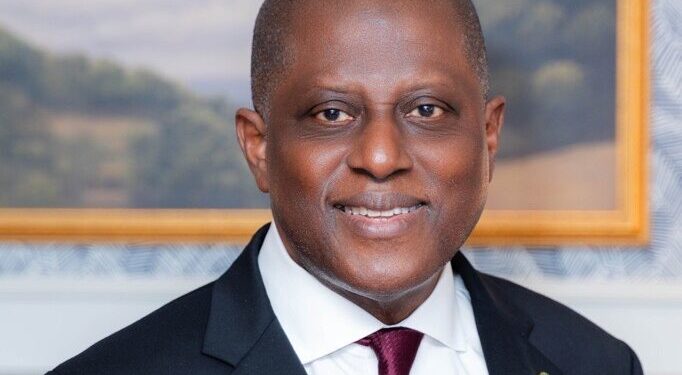

Photo: Olayemi Cardoso, CBN Governor

Nigeria’s local currency may be trading significantly below its true worth, according to renowned economist Bismarck Rewane, who estimates the naira’s fair value at about N1,257 to the dollar.

Rewane, the Managing Director of Financial Derivatives Company (FDC), said an analysis based on the purchasing power parity (PPP) framework suggests that the naira is undervalued by approximately 11 per cent, a situation he noted is not unusual for emerging-market currencies.

He made the remarks while speaking at the 2026 Economic Outlook forum organised by the Association of Corporate Treasurers of Nigeria (ACTN), where discussions centred on exchange-rate risks, liquidity management and macroeconomic outlook.

According to Rewane, currencies tend to gradually adjust toward their PPP-implied levels over a medium-term horizon of around five years, implying that the naira could appreciate toward its estimated equilibrium over time.

He placed the current PPP-derived exchange rate at N1,256.79 per dollar, arguing that this valuation supports the view that the naira remains below its long-term fair price.

Shifting focus to corporate finance, Rewane said the foremost duty of treasurers is the prudent management and optimisation of liquid assets, particularly in periods of foreign-exchange volatility. He urged corporate treasurers to strike a balance between optimism and caution when managing FX exposure.

The event also featured a panel session involving Adeyinka Ogunnubi of CFAO Nigeria and Titilola Osinowo of Ardova Plc, who shared practical insights on treasury operations in a volatile economic environment.

Meanwhile, the naira began the final week of January 2026 on a stronger note at the official market, supported by improved liquidity and targeted interventions by the Central Bank of Nigeria (CBN).

At the Nigerian Foreign Exchange Market (NFEM), the naira appreciated to about N1,413.41 per dollar, improving from last week’s close of N1,421.90. Analysts attribute the gain to cleared FX backlogs, steady crude oil earnings, foreign portfolio inflows, and a more transparent price discovery process.

In the parallel market, the dollar traded between N1,475 and N1,490 across major cities, reflecting relative stability and a narrower gap with the official rate. Bureau De Change operators reported adequate supply meeting retail demand, limiting speculative pressure.

Overall, market watchers expect the naira to remain largely stable in the near term, as improved liquidity conditions and positive macroeconomic projections for 2026 support a range-bound outlook for the currency.