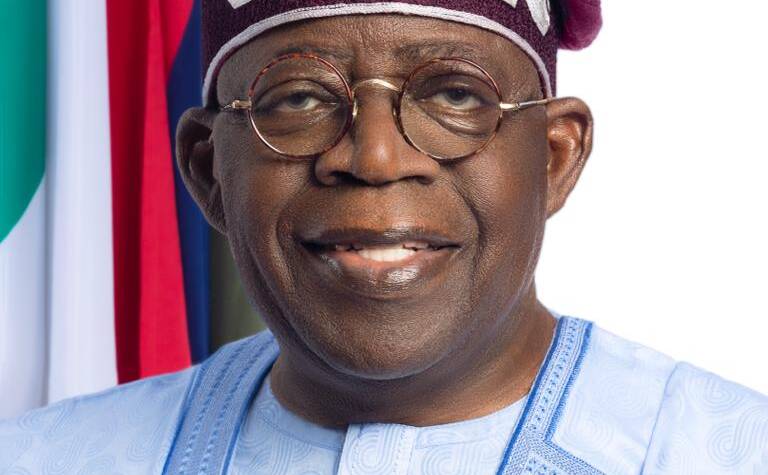

Moody’s Investors Service has upgraded Nigeria’s long-term issuer ratings from Caa1 to B3, assigning a stable outlook—its second positive action on the country’s credit profile in under a year. The upgrade reflects growing confidence in Nigeria’s economic direction under President Bola Ahmed Tinubu’s administration.

The Federal Government hailed the decision as further validation of its reform-driven efforts to stabilize the economy and attract investment.

Moody’s cited notable improvements in Nigeria’s fiscal and external positions, supported by policy shifts since President Tinubu took office in May 2023. Key reforms include a more flexible foreign exchange regime, removal of fuel subsidies, tax reforms, and broader efforts to restore macroeconomic stability and fiscal transparency.

The rating upgrade follows a similar move by Fitch Ratings just two months ago, which raised Nigeria’s rating from ‘B-’ to ‘B’ with a stable outlook, citing positive macroeconomic trends.

This latest move marks a one-notch improvement in Nigeria’s creditworthiness, moving the country out of the “very high risk” category. While risks remain, the upgrade signals increased global confidence and could lead to lower borrowing costs, greater access to foreign capital, and a rise in foreign direct and portfolio investments.

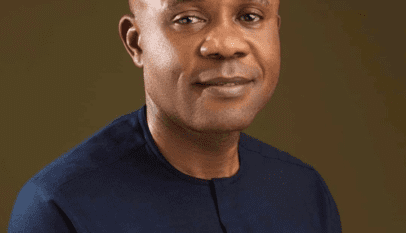

Finance Minister Wale Edun said Moody’s recognition is a testament to the administration’s resolve to achieve economic stability and sustainable growth. “Our reforms are tough but necessary,” he noted, highlighting the role of various government agencies, including the Central Bank of Nigeria, in driving recovery.

The Federal Ministry of Finance emphasized that the timing of the upgrade aligns with the government’s push for private sector-led growth, improved infrastructure financing, and an expanded financial sector.

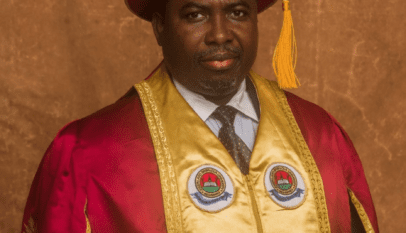

Economist Dr. Wahab Balogun, CEO of Ambosit Capital Managers, described the dual upgrades by Fitch and Moody’s as strong indicators that Nigeria is regaining credibility in global finance. He noted that the stable outlook suggests the reforms are seen as credible, but stressed that sustained implementation will be key to realizing long-term benefits.

With better ratings, Nigeria is better positioned to re-engage with international capital markets on improved terms, freeing up resources for development priorities such as infrastructure, economic diversification, and inclusive growth.