The Federation Account Allocation Committee (FAAC) has shared a record N2.001 trillion among the federal, state, and local governments as revenue generated in July 2025 — the highest monthly allocation so far this year.

The disbursement was confirmed on Friday during the FAAC’s August meeting in Abuja. The funds were drawn from various statutory revenue sources including Value Added Tax (VAT), the Electronic Money Transfer Levy (EMTL), and foreign exchange gains.

According to a statement by Mr. Bawa Mokwa, Director of Press and Public Relations at the Office of the Accountant General of the Federation (OAGF), the distributable revenue comprised N1.282 trillion in statutory revenue, N640.61 billion from VAT, N37.6 billion from EMTL, and N39.75 billion from exchange differences.

The total gross revenue for July stood at N3.836 trillion. From this amount, N152.68 billion was deducted to cover the cost of revenue collection, while N1.683 trillion was earmarked for transfers, refunds, interventions, and savings.

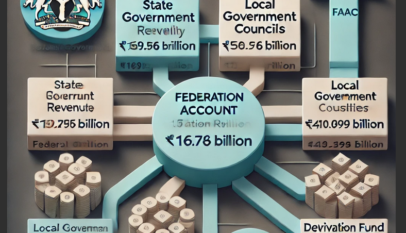

The breakdown of allocations is as follows: Federal Government: N735.08 billion, State Governments: N660.35 billion, Local Government Councils: N485.04 billion, and Oil-Producing States (13% Derivation): N120.36 billion

A closer look at the statutory revenue (N1.282 trillion) reveals that: The Federal Government received N613.81 billion, States got N311.33 billion, Local Governments received N240.02 billion, while Oil-producing states were allocated N117.71 billion as derivation

From the N640.61 billion VAT pool: The Federal Government took N96.09 billion, States received N320.31 billion, Local Governments shared N224.21 billion

The N37.6 billion generated from EMTL was distributed as follows: Federal Government: N5.64 billion, States: N18.8 billion, and Local Governments: N13.16 billion. In addition, the N39.75 billion realized from exchange gains was shared among the three tiers: Federal Government: N19.54 billion, States: N9.91 billion, Local Governments: N7.64 billion, and Oil-producing states (derivation): N2.64 billion

The FAAC communiqué noted significant increases in revenue from Petroleum Profit Tax (PPT), Oil and Gas Royalties, EMTL, and Excise Duties. VAT and Import Duty saw marginal growth, while Companies Income Tax (CIT) and Common External Tariff (CET) Levies declined during the month.

This distribution marks a notable fiscal milestone amid efforts to stabilize public finances and enhance revenue collection at all levels of government.