The Economic and Financial Crimes Commission (EFCC) has implicated a new-generation commercial bank, six fintech companies and several microfinance banks in a large-scale financial fraud involving cryptocurrency transactions valued at N162 billion.

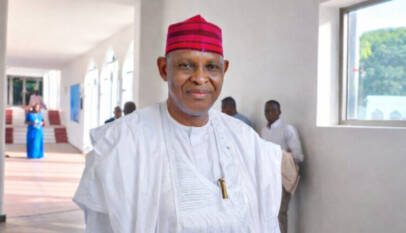

The Commission disclosed this on Thursday during a press briefing at its headquarters in Abuja, where its Director of Public Affairs, Mr. Wilson Uwujaren, accused the affected financial institutions of failing to carry out proper customer due diligence, thereby enabling fraudsters to launder illicit funds through the financial system.

Uwujaren said EFCC investigations revealed that the institutions allowed suspicious transactions to pass through their platforms during the 2024/2025 financial year, in violation of Know-Your-Customer (KYC) and anti-money laundering regulations. He noted that weak internal controls made it possible for criminals to convert proceeds of fraud into digital assets and move them to undisclosed destinations.

According to him, N18.1 billion was moved through the financial system without adequate customer verification, while cryptocurrency transactions worth N162 billion reportedly passed through a new-generation bank without any form of due diligence. He further disclosed that the Commission uncovered a case in which a single individual allegedly operated 960 accounts within one bank for fraudulent activities.

Uwujaren described the development as troubling but said EFCC intervention had led to the recovery of N33.62 million, which has already been returned to some victims.

The EFCC spokesperson explained that investigations uncovered two major fraud schemes linked to the compromised institutions. The first involved an airline ticket discount scam in which a syndicate advertised heavily discounted tickets for a foreign airline. Victims were led to believe their payments were going directly to the airline, but once transactions were completed, funds in their accounts were allegedly wiped out. The scheme reportedly affected more than 700 victims, with losses estimated at N651 million, and was said to be masterminded by a foreign national. About N33 million has so far been recovered and refunded to victims.

The second scheme involved a fraudulent investment platform operating as Fred and Farid Investment Limited, also known as FF Investment. Uwujaren said over 200,000 Nigerians were defrauded through fake investment packages that generated about N18 billion. The scheme allegedly operated through multiple companies, including Credio Banco Limited, Deliberty Rock Limited, Liam Chumeks Global Service, Ngwuoke Daniels Technology, Icons Autos and Import Merchant, Newpace Technology Services Limited, Primepath Ways Ventures Limited, Kaka Synergy Network Limited and Sunlight Tech Hub Services Limited.

According to the EFCC, the scheme was orchestrated by foreign nationals working with three Nigerian accomplices who have been arrested and charged to court, while efforts are ongoing to apprehend the foreign suspects who are currently on the run.

Uwujaren called on financial regulators to enforce stricter compliance with KYC, Customer Due Diligence and Suspicious Transaction Reports, urging them to suspend and refer to the EFCC any banks or fintechs found to be aiding fraudsters for investigation and possible prosecution. He warned that negligence in monitoring structured and suspicious transactions exposes the economy to serious systemic risks.

He also disclosed that as part of its broader anti-corruption drive, the EFCC recently recovered N1.234 billion from Sujimoto Luxury Construction Limited and returned the funds to the Enugu State Government following the company’s failure to execute a contract for the construction of 22 smart schools despite receiving over N2.28 billion in advance payments.