By Douglas Maha, Abuja

Nigeria’s public debt has climbed to ₦152.4 trillion ($99.7bn) as of June 30, 2025, from ₦149.4 trillion recorded three months earlier, according to the latest figures from the Debt Management Office (DMO). The increase of ₦3.01 trillion, or about 2%, was driven by a weaker naira that inflated the local value of foreign borrowings, alongside limited new debt issuance.

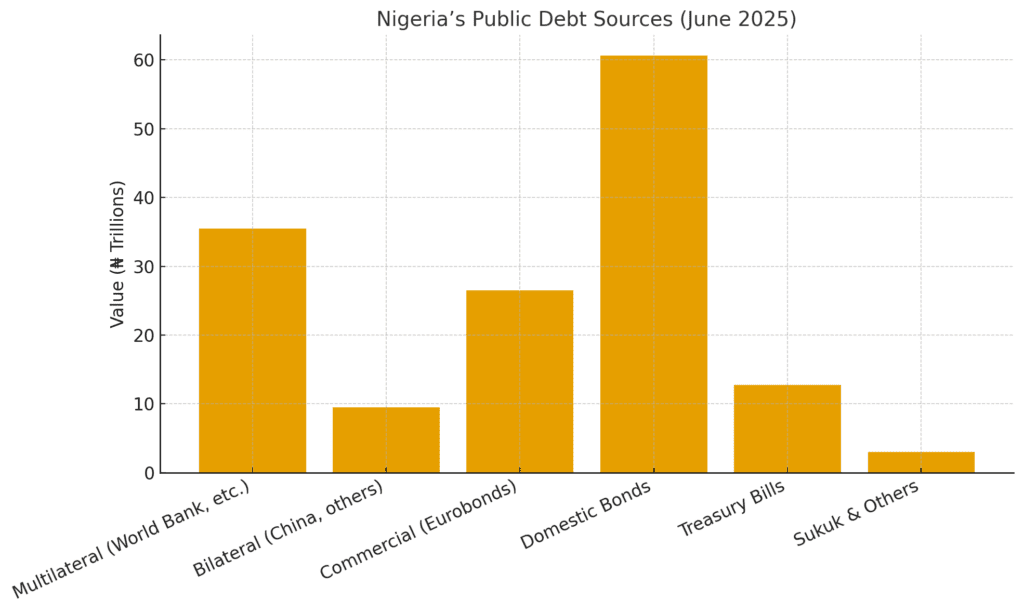

The DMO said total external debt rose to $46.98bn (₦71.85tn) in June from $45.98bn (₦70.63tn) in March. Multilateral lenders remain Nigeria’s largest creditors, holding about $23.19bn, almost half of the total.

The World Bank’s International Development Association (IDA) alone accounts for $18.04bn, while bilateral loans total $6.2bn, largely owed to the Export-Import Bank of China. Commercial borrowings, mostly Eurobonds, stand at $17.3bn, leaving the country exposed to fluctuations in global markets and interest rates.

Domestic obligations also increased to ₦80.55 trillion from ₦78.76 trillion. The portfolio is dominated by long-term federal government bonds worth ₦60.65 trillion, which include ₦22.72 trillion in securitised advances from the Central Bank of Nigeria.

Treasury bills amount to ₦12.76 trillion, while Sukuk, savings bonds, and other instruments make up smaller portions. Analysts say the continued growth of securitised Ways and Means advances underscores the government’s reliance on borrowing to finance persistent budget shortfalls.

The Federal Government accounts for ₦141.08 trillion, or about 93% of total public debt, comprising ₦64.49 trillion in external obligations and ₦76.59 trillion in domestic debt. States and the Federal Capital Territory owe a combined ₦11.32 trillion, including $4.81bn (₦7.36tn) in external loans and ₦3.96 trillion in domestic debt.

The DMO said foreign loans were converted using the official Central Bank rate of ₦1,529.21 to the dollar as of June 30, 2025. The depreciation of the naira compared with earlier in the year significantly inflated the naira value of external debt, adding to the rise in the overall stock even with minimal fresh borrowing.

Although Nigeria’s debt-to-GDP ratio remains within international limits, the steady expansion of public debt and the rising cost of servicing it has raised concerns about fiscal sustainability. Economists warn that unless the government boosts revenue generation, curbs spending inefficiencies, and reduces its dependence on borrowing, debt repayments could increasingly limit funding for infrastructure, education, and social programmes.

The DMO’s latest figures highlight the fragility of Nigeria’s public finances, showing how exchange rate pressures and weak fiscal buffers continue to shape the country’s growing debt burden.