The House of Representatives has inaugurated an ad hoc committee to review the economic, regulatory, and security implications of cryptocurrency adoption and Point-of-Sale (POS) operations in Nigeria amid growing concerns over cybercrime, money laundering, and terrorism financing linked to digital finance platforms.

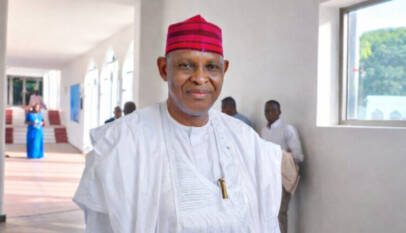

Speaker of the House, Abbas Tajudeen, while inaugurating the committee on Monday in Abuja, said the initiative became necessary to address the increasing cases of fraud and consumer exploitation within the country’s fast-expanding digital finance ecosystem.

Abbas noted that although Nigeria’s economy has shown resilience and potential to support cryptocurrency growth, the absence of clear regulatory guidelines and the risks associated with unregulated digital assets posed significant dangers.

“It is because of this absence of clear rules, coupled with the volatility and complexity of the technology, that the House of Representatives found it imperative to establish regulations and consumer protection measures that will regulate the activities of Virtual Assets Service Providers, including cryptocurrencies and crypto assets,” he said.

The Speaker explained that the committee would hold public hearings to gather input from relevant stakeholders and experts to guide the National Assembly in developing a comprehensive legal and regulatory framework for cryptocurrency and other digital finance platforms.

He urged members of the committee to carry out their mandate with patriotism, integrity, and a sense of national responsibility, ensuring that their recommendations protect Nigeria’s economy and citizens.

In his remarks, the Chairman of the Committee, Olufemi Bamisile (APC–Ekiti), described the assignment as one of national importance aimed at finding a balance between financial innovation and national security.

“We have been entrusted with a task of national significance — to review the economic, regulatory, and security implications of cryptocurrency adoption and Point-of-Sale operations in Nigeria,” Bamisile stated.

He added that the committee would collaborate with key regulatory and security institutions, including the Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC), Nigeria Deposit Insurance Corporation (NDIC), Nigerian Financial Intelligence Unit (NFIU), Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Nigeria Police Force.