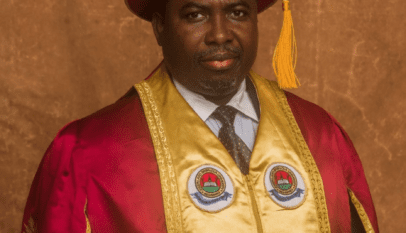

Photo: Oando Group CEO Wale Tinubu is President Tinubu’s cousin

Oando faces daily protests, unpaid invoices, and bankruptcy fears among suppliers’ months after AGIP takeover.

Oil giant Oando Plc has appointed Mrs. Folasade Ibidapo-Obe as its new Secretary and Chief Compliance Officer, stepping into the role at a time the company is mired in a deepening debt crisis that has left many contractors on the brink of collapse.

The appointment, announced in a regulatory filing to the Nigerian Exchange Group (NGX) on Friday, August 8, 2025, took immediate effect. Mrs. Ibidapo-Obe replaces Ms. Ayotola Jagun, who became an Executive Director in May.

But behind the official notice lies a growing financial scandal. Oando, which recently acquired AGIP’s operations in Port Harcourt, has become the target of near-daily protests by indigenous contractors and petroleum product suppliers claiming they are owed months—sometimes years—of unpaid invoices.

“It’s a disaster,” said one contractor, who asked not to be named for fear of retaliation. “Creditors are seizing assets. Some of us are losing everything. Oando’s accounts department doesn’t care—maybe because of Wale Tinubu’s political connections.”

Supplies that once attracted payment within weeks are now left in limbo for months. One supplier told our reporter they delivered diesel and PMS in January under a four-week payment promise. “Eight months later, nothing. We can’t survive like this,” he said.

Initially, contractors were told the payment delays were due to the ownership change from AGIP to Oando. But as the months dragged on and promises were repeatedly broken, the explanations kept shifting.

Several contractors say those who dared to protest have been blacklisted. “They shut you out completely if you speak up,” another source claimed. “Now we’re all trapped, waiting for money that may never come.”

The company has yet to respond to questions about the debt claims, the protests, or the alleged blacklisting of suppliers.

For Oando’s new compliance chief, the task ahead is not just regulatory housekeeping—it’s steering a company through a reputational crisis that is rapidly spilling into the public eye.