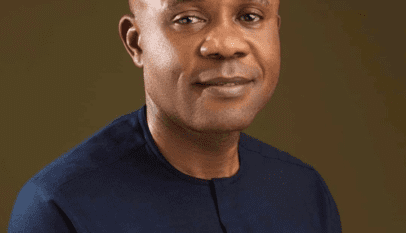

ExxonMobil Corporation’s sale of its Nigerian onshore assets to Seplat Energy is expected to receive final approval in the coming days, following clearance from the country’s regulatory body, President Bola Tinubu announced on Tuesday.

The $1.28 billion transaction, which was first unveiled in 2022, has been closely monitored by industry experts, and many see it as a bellwether for future deals.

Analysts believe the successful completion of this sale could pave the way for other transactions, including Shell’s asset sale to Renaissance earlier this year, which is also awaiting regulatory approval.

The Nigerian president made the revelation in a televised address marking Nigeria’s 64th Independence Day, reasserting his administration’s commitment to fostering a business-friendly environment while maintaining strict adherence to regulatory standards.

“The ExxonMobil-Seplat divestment will receive ministerial approval within days, now that it has been cleared by the regulator,” Tinubu stated.

Although the Nigerian Upstream Petroleum Regulatory Commission has yet to formally announce its decision, the impending approval is seen as a crucial step for Nigeria’s oil sector.

He said the deal would create vibrancy and increase Africa’s highest oil-producing country’s oil and gas production, as well as impact the economy.

The country, Africa’s largest crude producer, has struggled to boost its oil output, facing setbacks from crude theft and pipeline vandalism in the Niger Delta. This has prompted companies like Exxon and Shell to shift focus towards deep-water projects for future growth.

Just last week, the presidency disclosed that ExxonMobil had proposed a $10 billion investment in Nigeria’s offshore oil operations, signalling a renewed commitment to the country’s energy sector.

President Tinubu also highlighted his administration’s reform efforts aimed at attracting investors, claiming that Nigeria has drawn in over $30 billion in foreign direct investment since he took office.

However, his economic policies—such as easing foreign exchange controls, devaluing the Naira, and slashing subsidies on fuel and electricity—have exacerbated the country’s cost-of-living crisis, fueling public discontent.

To further entice investors, Tinubu promised additional fiscal reforms, including reducing taxes on businesses, to ensure Nigeria remains an attractive destination for foreign capital.

Benefits of the Multibillion-Dollar Deal to Nigeria’s Oil and Gas Industry

- Access to Strategic Assets: By acquiring ExxonMobil’s onshore assets, Seplat and its investors gain access to established oil-producing fields in Nigeria. These assets are located in a country with one of the largest oil reserves in Africa, offering significant production potential.

- Favorable Investment Environment: President Bola Tinubu’s administration is committed to creating a more investor-friendly climate in Nigeria. The swift approval of this deal signals that the government is willing to streamline regulatory processes, which can reduce delays and uncertainty for investors involved in energy projects.

- Potential for Future Deals: The approval of ExxonMobil’s divestment sets a positive precedent for similar deals, such as Shell’s pending asset sale to Renaissance. This could open up further opportunities for investors to acquire high-value assets in Nigeria’s oil and gas sector, with reduced regulatory risks.

- Market Confidence and Foreign Investment Reforms: Tinubu’s economic reforms, including efforts to attract foreign direct investment, could improve investor confidence. These reforms include reducing forex controls, devaluing the naira, and cutting taxes for businesses, all aimed at creating a more favorable investment environment.

- Long-Term Growth Opportunities: Despite challenges in Nigeria’s oil sector, such as pipeline vandalism and theft, the country’s untapped oil reserves, particularly in deepwater regions, present significant growth potential. With ExxonMobil’s planned $10 billion investment in offshore operations, investors may see long-term returns from new developments in Nigeria’s energy sector.

- Diversification of Seplat’s Portfolio: The acquisition of ExxonMobil’s onshore assets will diversify Seplat Energy’s portfolio, spreading risk and potentially stabilizing revenue streams. For investors in Seplat, this provides a more secure and balanced investment as the company expands both its onshore and offshore operations.

Oil industry sources are unanimous that by taking advantage of the deal and its benefits, investors could see substantial returns as Nigeria continues to reform its regulatory and economic landscape to attract global capital.