The proposed merger between Unity Bank Plc and Providus Bank Limited has moved closer to completion following a Court-Ordered Meeting and endorsement by shareholders, signaling steady progress toward final integration.

Analysts say the regulatory backing and shareholder approval represent a significant milestone in meeting recapitalisation requirements within the timeline set by the Central Bank of Nigeria (CBN).

Through the merger, the combined capital base of the two banks will exceed N200 billion — the minimum threshold required to retain a national banking licence under the CBN’s recapitalisation framework. The transaction is expected to strengthen the financial stability, operational capacity, and long-term competitiveness of the enlarged institution.

The CBN has backed the merger with a pivotal financial accommodation to support the transaction. It also received a “no objection” approval from the Securities and Exchange Commission (SEC), alongside other regulatory clearances. The approvals are part of broader efforts to enhance the resilience of Nigeria’s banking sector, reinforce capital adequacy, and mitigate systemic risks.

With the development, the combined entity is positioned among the 21 banks that have met the new capital requirement for national banking operations.

Shareholders of both banks endorsed the merger at their respective Extraordinary General Meetings in September, following the CBN’s approval. Integration processes are currently underway, with only the final court sanction remaining to conclude the transaction.

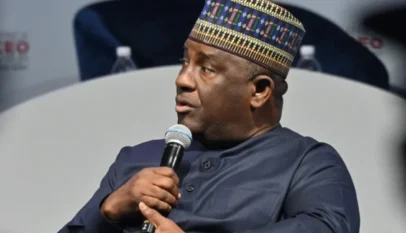

Managing Director and Chief Executive Officer of Unity Bank, Ebenezer Kolawole, described the development as a defining moment for the institution.

“This milestone underscores our commitment to building a stronger, more resilient bank that can deliver greater value to our customers and stakeholders. The merger with Providus Bank significantly enhances our capital base, operational capacity, and strategic positioning. We are confident that the combined institution will be better equipped to support economic growth and deliver innovative financial solutions across Nigeria,” he said.

The bank also dismissed reports suggesting that the merger process had stalled, stating that the transaction remains firmly on course, with the remaining steps largely procedural.

When finalized, the Unity-Providus combination is expected to create a stronger, more competitive, and customer-focused financial institution with the scale and reach to reshape retail and SME banking in Nigeria.