A total of N1.678 trillion in Federation Account revenue for February 2025 has been distributed among the Federal Government, State Governments, and Local Government Councils, which is N25 billion lower than N1.703 trillion in January.

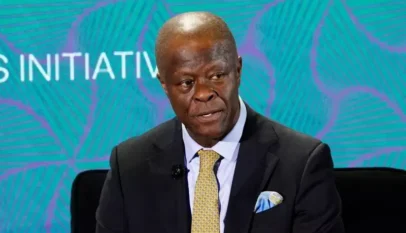

The allocation was finalized during the March 2025 meeting of the Federation Account Allocation Committee (FAAC) in Abuja, chaired by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy.

The N1.678 trillion disbursement marks a slight decline from the N1.703 trillion allocated in January 2025. The February allocation reflects a reduction of N25 billion, or approximately 1.47%, compared to the previous month’s allocation.

A notable augmentation of N178 billion was also shared among the three tiers of government, with the Federal Government receiving N93.770 billion, State Governments receiving N47.562 billion, and Local Government Councils allocated N36.668 billion.

Breakdown of the Total Distributable Revenue

According to a communiqué issued at the end of the FAAC meeting, the total distributable revenue of N1.678 trillion included various revenue streams. The revenue was made up of the following:

- Distributable Statutory Revenue: N827.633 billion

- Value Added Tax (VAT): N609.430 billion

- Electronic Money Transfer Levy (EMTL): N35.171 billion

- Solid Minerals Revenue: N28.218 billion

- Augmentation: N178.000 billion

This total was drawn from gross revenue of N2.344 trillion, which also included deductions for revenue collection costs amounting to N89.092 billion. Additionally, N577.097 billion was earmarked for transfers, interventions, refunds, and savings.

Key Revenue Figures

The allocation saw a significant decrease in statutory revenue for February, with the gross statutory revenue recorded at N1.653 trillion—a drop of N194.664 billion from the N1.848 trillion recorded in January 2025. VAT revenue also saw a decline, with the amount collected in February totalling N654.456 billion, down by N117.430 billion from the previous month’s N771.886 billion.

Revenue Distribution for February 2025

- Federal Government: The Federal Government received a total of N569.656 billion (33.94% of the total distributable revenue). This amount includes allocations from statutory revenue, VAT, EMTL, and solid minerals.

- State Governments: State Governments received a combined total of N562.195 billion (33.51% of the total distributable revenue).

- Local Government Councils: Local Government Councils were allocated N410.559 billion (24.47% of the total distributable revenue).

- Oil and Mineral-Producing States: These states received N136.042 billion as part of the 13% derivation revenue from oil and mineral resources.

Detailed Breakdown of the Revenue Components

- Statutory Revenue (N827.633 Billion)

- Federal Government: N366.262 billion (21.85% of total distributable revenue)

- State Governments: N185.773 billion (11.08% of total distributable revenue)

- Local Government Councils: N143.223 billion (8.54% of total distributable revenue)

- Derivation Revenue: N132.374 billion (7.89% of total distributable revenue)

- VAT Revenue (N609.430 Billion)

- Federal Government: N91.415 billion (5.45% of total distributable revenue)

- State Governments: N304.715 billion (18.16% of total distributable revenue)

- Local Government Councils: N213.301 billion (12.72% of total distributable revenue)

- EMTL Revenue (N35.171 Billion)

- Federal Government: N5.276 billion (0.31% of total distributable revenue)

- State Governments: N17.585 billion (1.05% of total distributable revenue)

- Local Government Councils: N12.310 billion (0.73% of total distributable revenue)

- Solid Minerals Revenue (N28.218 Billion)

- Federal Government: N12.933 billion (0.77% of total distributable revenue)

- State Governments: N6.560 billion (0.39% of total distributable revenue)

- Local Government Councils: N5.057 billion (0.30% of total distributable revenue)

- Derivation Revenue: N3.668 billion (0.22% of total distributable revenue)

Insights and Revenue Trends

The FAAC noted significant increases in revenue from Oil and Gas Royalties and the Electronic Money Transfer Levy (EMTL) for February 2025. However, collections from other major revenue sources—including VAT, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Excise Duty, Import Duty, and CET Levies—showed a noticeable decline.

The meeting, which was attended by key officials such as the newly appointed Accountant General of the Federation, Shamseldeen Ogunjimi, and representatives from state governments and revenue-generating agencies, underscored the need for continued efforts to diversify revenue sources amid fluctuating global market conditions and internal challenges.

Conclusion

This revenue distribution reflects both the challenges and opportunities facing Nigeria’s fiscal system. With a slight decrease in February’s overall allocation, coupled with fluctuations in key revenue sources, it underscores the importance of managing resources efficiently while diversifying revenue streams to maintain stability across all tiers of government.

The allocation breakdown shows a relatively balanced distribution, with Federal and State Governments receiving significant shares, but Local Government Councils also receiving crucial funding for local projects and governance.