The shares of Meta Platforms, owner of Facebook, Instagram and WhatsApp, surged on Friday after reports that the United States of America government could ban rival Tiktok, owned by China-base BytDance.

The development followed a US Appeal Court ruling that upheld the law mandating ByteDance to divest its interest from the fast-growing TikTok within the first three weeks of 2025 or face a ban in the US.

ByteDance’s TikTok has over 170m American subscribers and receives tons of advertisement income, and the controversial ban could cost it billions of dollars in revenue.

It is anticipated that TikTok revenue loss could lead to a revenue windfall for Meta Platforms and other TikTok competitors.

TikTok has emerged as a strong force in social media with its short video content, which allows users to post and share information and entertain.

The company has consistently argued that the law under which it is prosecuted is unlawful and against free speech rights conferred on citizens by the Constitution.

ByteDance is expected to contest the Appeal Court ruling that Supreme Court

A report by the reputable news agency, Reuters, said the company is also exploring other options if the legal options fail

The report said the company wrote to advertisers on Friday, informing them of its plan to appeal the ruling.

TikTok’s president of global business solutions Blake Chandlee said the company planned to seek “an injunction to stop the TikTok ban from going into effect until the U.S. Supreme Court has an opportunity to review it.”

With TikTok’s future in the U.S. uncertain, advertising executives said brands are maintaining their activities on TikTop while ensuring they have a plan B.

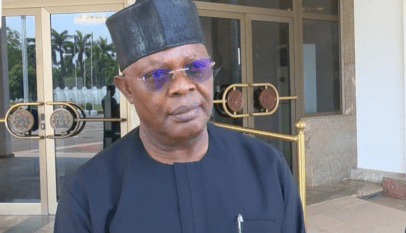

Advertisers have not pulled back from TikTok, though several are developing contingency plans for potential reallocation of investment should there be a ban,” said Jason Lee, executive vice president of brand safety at media agency Horizon Media.

Horizon is working with clients to prepare for a variety of scenarios if the app is sold or banned, Lee said.

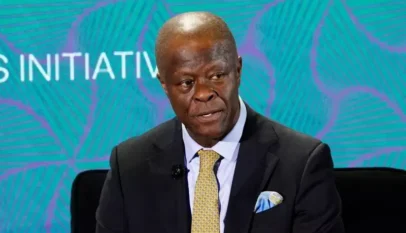

Meta Platforms (META.O), opens new tab, owner of Facebook and Instagram, stands to gain the majority of TikTok’s ad revenue if the app is banned, followed by Alphabet’s (GOOGL.O), opens new tab YouTube, said Erik Huberman, CEO of marketing agency Hawke Media.

Both companies have introduced short-form video features in the past few years to compete with TikTok.