By Deborah Nnamdi

Chairman of the Dangote Group, Aliko Dangote, has projected that the naira could appreciate to as low as N1,100 to the dollar this year, citing the impact of the Federal Government’s industrial and economic reform policies.

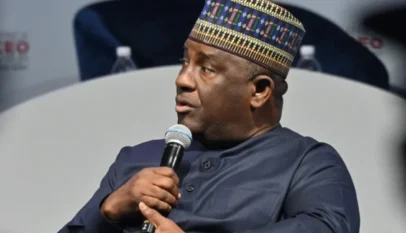

Dangote made the projection on Tuesday, February 17, 2026, while speaking at the launch of the Nigeria Industrial Policy in Abuja. The event was attended by Vice President Kashim Shettima and other senior government officials.

According to him, ongoing reforms are already yielding positive results, particularly for manufacturers, who he said are beginning to feel the benefits of government policies.

“I believe with the policies that you have implemented in government, people now have started seeing the result, and manufacturers are very, very happy,” Dangote said.

He attributed the potential appreciation of the naira to efforts aimed at reducing import dependence and strengthening local production, which he said would ease pressure on foreign exchange demand.

“Today, the dollar is N1,340. Mr. Vice-President, I can assure you that, with what I know, by blocking all this importation, the currency this year will be as low as N1,100 if we are lucky,” he stated.

However, Dangote noted that the only factor that could prevent such appreciation would be a deliberate decision by the Federal Government to maintain a weaker naira in order to boost naira-denominated revenue.

“But it’s a catch-22 situation where, now, if the naira gets stronger, it means that everything will go down. Everything will go down because we are an import-based country, which we shouldn’t be. What we should be doing is manufacturing all the things that we need,” he added.

Dangote also called for stronger protection for local investors through targeted incentives and improved infrastructure, particularly reliable electricity supply, which he described as critical to industrial growth. He stressed that while the industrial policy is well-conceived, it must be backed by full support for industrialists to drive job creation and sustainable economic growth.

Economic analysts, however, caution that exchange rate performance depends on several variables, including oil prices, foreign capital inflows, monetary policy discipline, and global economic conditions. They note that sustained appreciation would require consistent forex supply, fiscal discipline, and continued structural reforms to boost domestic production and exports.

In a related development, billionaire businessman Femi Otedola recently projected that the naira could strengthen to below N1,000 per dollar before the end of the year, citing the attainment of full capacity by the Dangote Petroleum Refinery.

Otedola, Chairman of First Holdco, said the refinery’s capacity to supply up to 75 million litres of petrol daily could significantly reduce fuel imports and ease pressure on the country’s foreign exchange market.