By Douglas Maha, Abuja

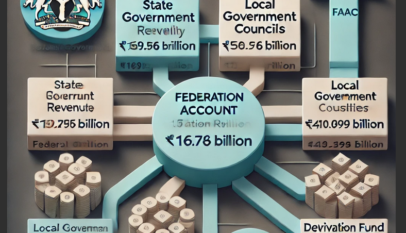

The Federation Account Allocation Committee (FAAC) has disbursed a total of N1.578 trillion to the federal, state, and local governments as revenue generated in March 2025. This was confirmed during the committee’s April meeting held in Abuja.

The figure represents a decline compared to the N1.802 trillion allocated in February 2025, marking the second consecutive month of reduced revenue distribution to the three tiers of government.

According to the official communique issued after the meeting, the gross revenue available for March stood at N2.411 trillion. From this amount, N85.376 billion was deducted as the cost of revenue collection, while transfers, interventions, and refunds accounted for another N747.180 billion.

This brought the total distributable revenue down to N1.578 trillion, lower than the previous month’s net distributable figure.

The March allocation was drawn from four main revenue sources: N931.325 billion from statutory revenue, N593.750 billion from Value Added Tax (VAT), N24.971 billion from the Electronic Money Transfer Levy (EMTL), and N28.711 billion from Exchange Difference revenue.

Despite the overall drop in allocation, statutory revenue for March saw an increase, rising to N1.718 trillion from N1.653 trillion in February—a difference of N65.422 billion. However, this gain was offset by declines in other areas. VAT revenue dropped from N654.456 billion in February to N637.618 billion in March, representing a decrease of N16.838 billion.

From the total distributable pool in March, the federal government received N528.696 billion, compared to N605.209 billion in February. State governments got N530.448 billion, down from N590.506 billion, while local governments received N387.002 billion, a drop from the N432.905 billion shared in the previous month. Oil-producing states were allocated N132.611 billion as 13 per cent derivation revenue, slightly down from the N141.167 billion they received in February.

Within the statutory revenue of N931.325 billion, the federal government was allocated N422.485 billion, the states N214.290 billion, and local governments N165.209 billion. Oil-producing states received N129.341 billion from this component as derivation revenue. From the VAT revenue of N593.750 billion, the federal government received N89.063 billion, while states and local governments got N296.875 billion and N207.813 billion, respectively.

The EMTL revenue of N24.971 billion was shared, with N3.746 billion going to the federal government, N12.485 billion to the states, and N8.740 billion to local governments. The Exchange Difference revenue of N28.711 billion was distributed as follows: N13.402 billion to the federal government, N6.798 billion to states, and N5.241 billion to local governments. An additional N3.270 billion from this revenue stream was given to oil-producing states as part of their derivation entitlement.

Despite the marginal improvement in Petroleum Profit Tax (PPT) and Companies Income Tax (CIT), several major revenue streams declined in March. These include Oil and Gas Royalty, EMTL, VAT, Excise Duty, Import Duty, and Common External Tariff (CET) levies.

This trend highlights the growing pressure on public finances and the importance of boosting non-oil revenue sources to stabilise future allocations.