As Nigerians gear up for the year-end season, the Body of Bank chief executives has assured customers of a steady cash supply across all branches and restated that the nation’s banking system remains safe.

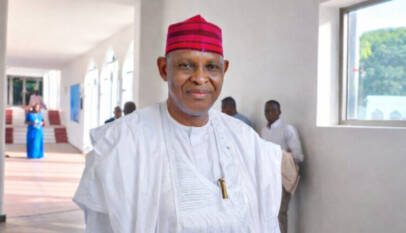

Group chairman of United Bank for Africa, Oliver Alawuba, who also chairs the Body of Bank CEOs, gave the assurance, noting that, for the banking industry to continue supporting sectors that can grow the economy, loan assets must be treated with discipline.

Alawuba, while observing that the festive season is fast approaching, assured Nigerians on behalf of bank CEOs that “We are fully mobilised, in partnership with the Central Bank of Nigeria, to ensure cash availability at branches. We will also make sure that during this period, all our digital touchpoints will work seamlessly so that you can have a smooth season.”

He maintained that the federal government’s ambition of building a one-trillion-dollar economy is a national priority that requires deeper reform, enhanced continuity, and inclusive growth. According to him, the banking industry remains committed to expanding credit to the private sector.

“I believe the private sector is so important. Today, the private sector lending position is about N74 trillion. We can do a lot more. We need to improve economic growth by providing more credit to the private sector. In providing this credit, we require responsive and responsible borrowing, time-dependent and properly managed frameworks,” he said.

“But bank credit is not a gift. Bank credit is not a grant. Bank credit is not to fund a lifestyle. It is a trust between the bank and the customer, benefiting both the industry and the country. Banks do not sell money. If banks lend money and the money comes back, I believe that we can fund the growth sectors of the economy, “he added.

While commending the Central Bank of Nigeria and the Federal Ministry of Finance for what he described as coordinated efforts that have helped stabilise the economy in recent months, he said, the impact of policy alignment between fiscal and monetary authorities was already evident in key indicators.

He noted that the inflation, which had previously spiked, has dropped to 16 per cent as of October. He added that the official foreign exchange market has also witnessed improved stability, with the naira now trading within a narrow band.

Alawuba further pointed out that SMEs contribute nearly half of the country’s economic output and more than 80 per cent of jobs, stressing that the sector cannot be allowed to fail. He also emphasised the role of women in achieving inclusive growth and urged banks to continue expanding access to financing for women-owned businesses.

He identified the creative industry as another growth frontier. He cited the banking sector’s support for the revitalisation of the National Theatre as an example of the opportunities emerging within the industry.

The UBA chairman reaffirmed the commitment of bank CEOs to professional conduct, compliance and ethical engagement with customers. He also expressed concern about rising risks in the digital economy, particularly AI-driven fraud and cross-border cyberattacks.

He said the Body of Bank CEOs will strengthen collaboration with the Central Bank, NIMC and other institutions to protect financial platforms and safeguard customers’ funds.